Alpha vs SP500 - What’s fair?

Disclaimer: These are not predictions. This is not advice. Yes this is cherry-picking of a successful collectible among endless failures ( that’s the point, to analyze the best-case scenario ). This is all just a thought experiment.

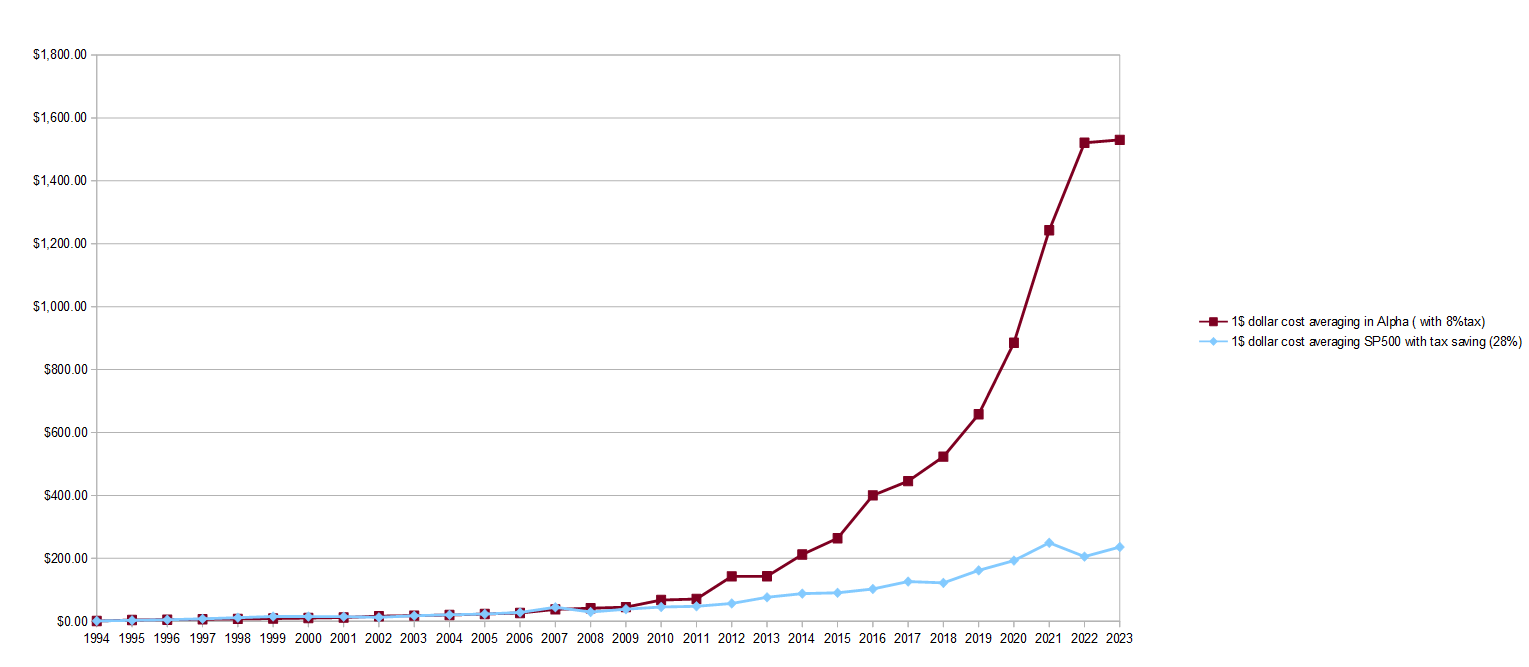

I’ve posted this graph before:

To which people replied that… it isn’t fair!

The point was just to showcase data, but obviously this is not a very meaningful comparison of “investing” in Alpha vs S&P500.

But what would be?

Well the benchmark is the dividends reinvested S&P500. That’s the no-brainer, no work “it just beats everything” investment that enjoys all the company matching and tax loophole schemes governments typically encourage in whatever country you’re in.

Next there’s income tax. I mainly used an average Canadian upper middle class income ( $75k range ) to make these calculations because if you aren’t making that kind of money you sure as hell shouldn’t be buying collectibles as investments. You get a tax break for putting money into index funds, meaning instead of having just 1$ to buy magic cards with, you’d have more like 1.28$ to buy index funds with.

This is a huge difference as you do….dollar cost averaging. That means you put some money every month/year into the market. This smooths out spikes and dips over time, removing a lot of the noise that confuse people. You don’t get to just say you bought a Bitcoin in 2014 and sat on it and that’s your comparison.

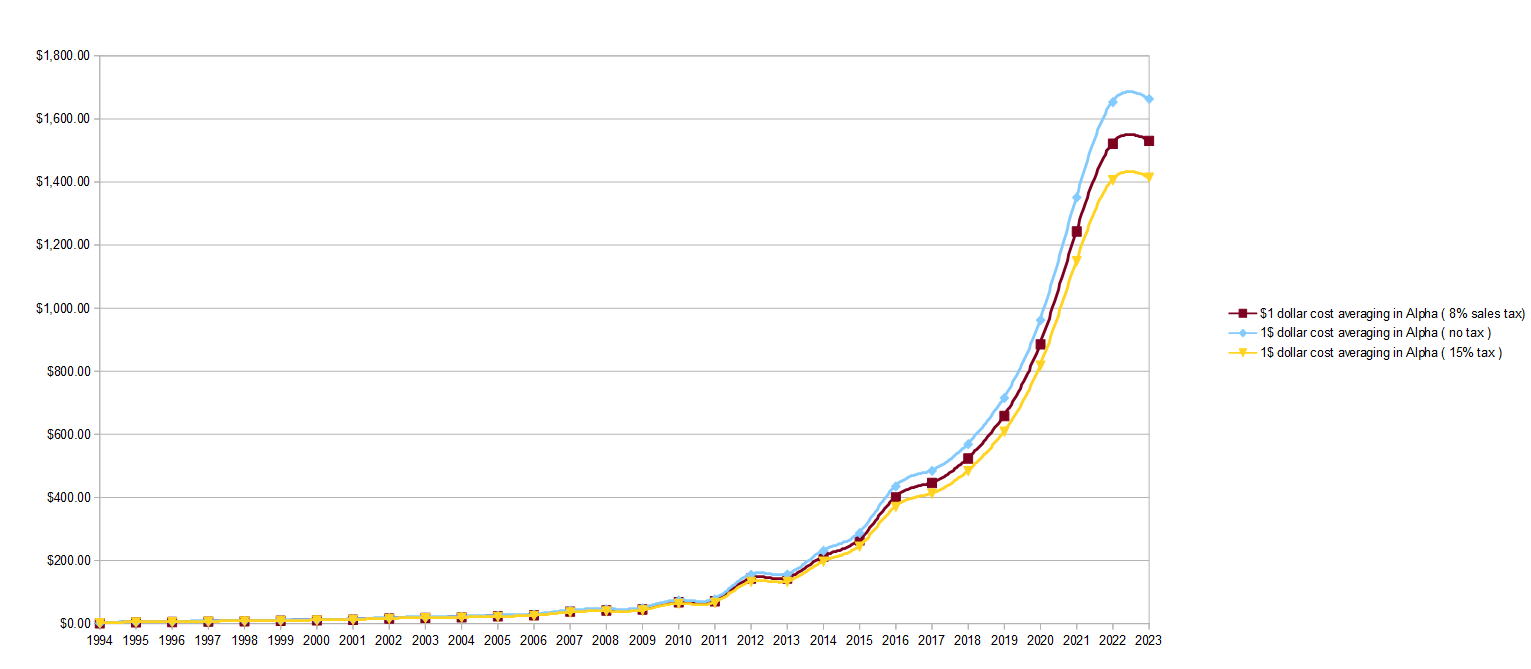

Now it gets trickier. Sales tax depends a lot on states/provinces. It could be 0% or 15% or more. I’m arbitrarily using 8%. If you buy magic cards on Facebook or in person without paying taxes, let’s pretend that 8% represents the time you wasted shopping.

Lastly is the cashout phase. Now that one’s wildly arbitrary. You could be paying as little as 0% or as much as 50% when you get out of a collectible, between the capital gains tax, the payment processor fees and the auction house fees. I’m using 28% as this is the USA’s long-term capital gains tax on collectibles ( I think ). Similarly for index funds what you pay depends on what account it’s in and what your income was. I’m just using 25% using the Canadian model of RRSP which gives you the tax break when you invest but taxes you when you withdraw. You can do the reverse (TFSA) where you get no tax break when you invest but the returns are tax-free. Which one is better for you depends on too many factors and you might be doing both anyway. As a rule of thumb with this, if index investing is close to collectibles returns, it’s a no brainer that the index fund has won that comparison.

So now you get this graph:

The earlier ludicrous 20:1 ratio is now down closer to 6:1

If you tweak the numbers you can get quite different outcomes so always keep your own situation in mind.

Somewhat interesting to note that the final gap is roughly the same as the difference in tax rates. Makes the math easier.

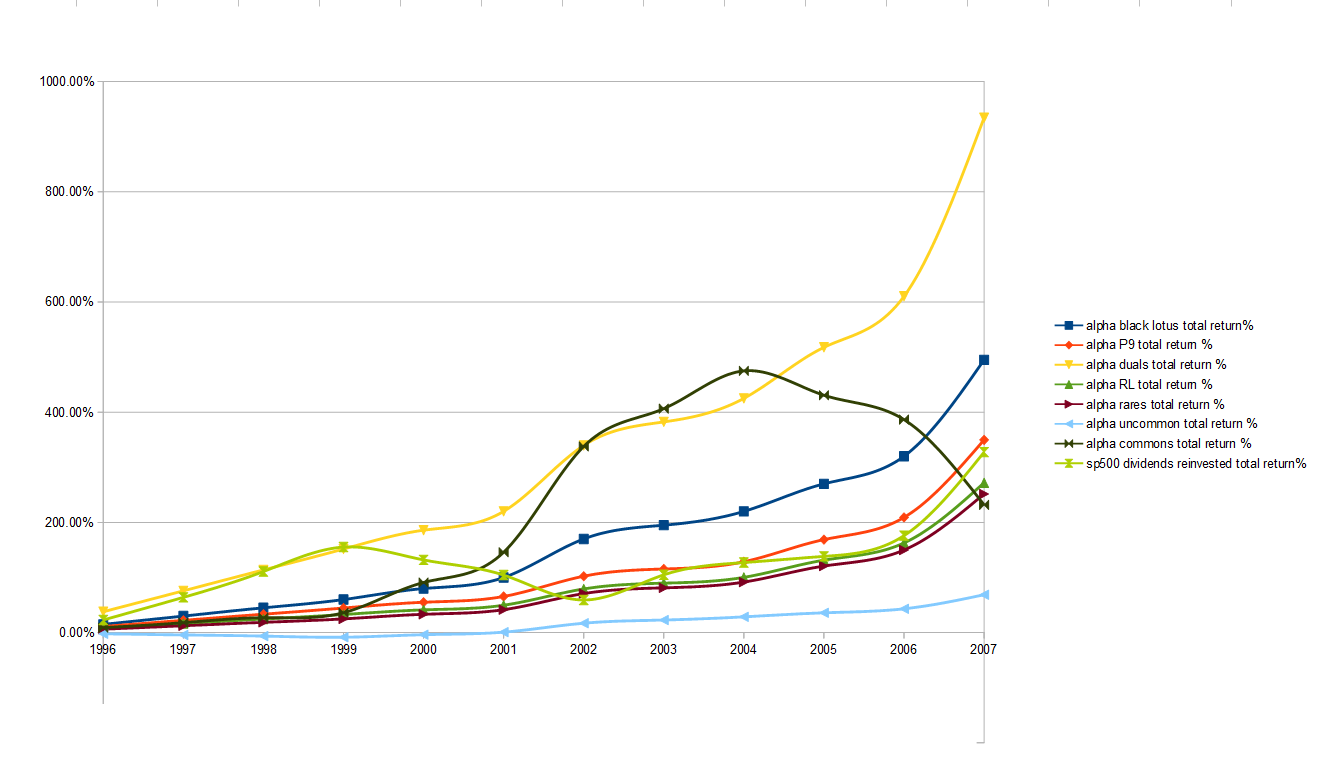

Another thing to notice about the data is that it busts a pretty common Reddit myth that “the easy money is gone” and “the best time to invest was at the start” blabla.

Turns out if you isolate the earlier years and exclude the release year ( where Alpha instantly quadrupled in price ) you find that pretty much the best time to start investing in MTG was probably around 2010, 17 years after the game came out.

You also notice here that the Black Lotus or Power 9 wasn’t the best performers, strangely enough. It was Dual Lands that did the best. The later trend becomes Lotus > P9 > Duals > RL > Rares. And notice commons taking a huge nosedive as you transition from Scrye prices to internet prices.

So is that fair enough? I’m curious to see what people think as I try to find a fair comparison method to use going forward.

Source/ Method for the MTG data: https://www.thepoxbox.com/posts/whats-my-card-worth

Source for S&P 500: https://www.slickcharts.com/sp500/returns/details

Other MTG related content:

Should I buy this collectible? - Another flowchart for Timmy

Investing in Collectibles - Is it dumb? - Initial look at the suspiciously high ROI of MTG

Omg should I grade this? - How rare is your card, really?

Magic Post-Covid market bloodbath - Coming off the 2021 cocaine high

Where do I sell my cards? - A flowchart for Timmy