Comparing A/B/U

Let’s just have a quick look at the returns of the first 3 sets of Magic’s History through time!

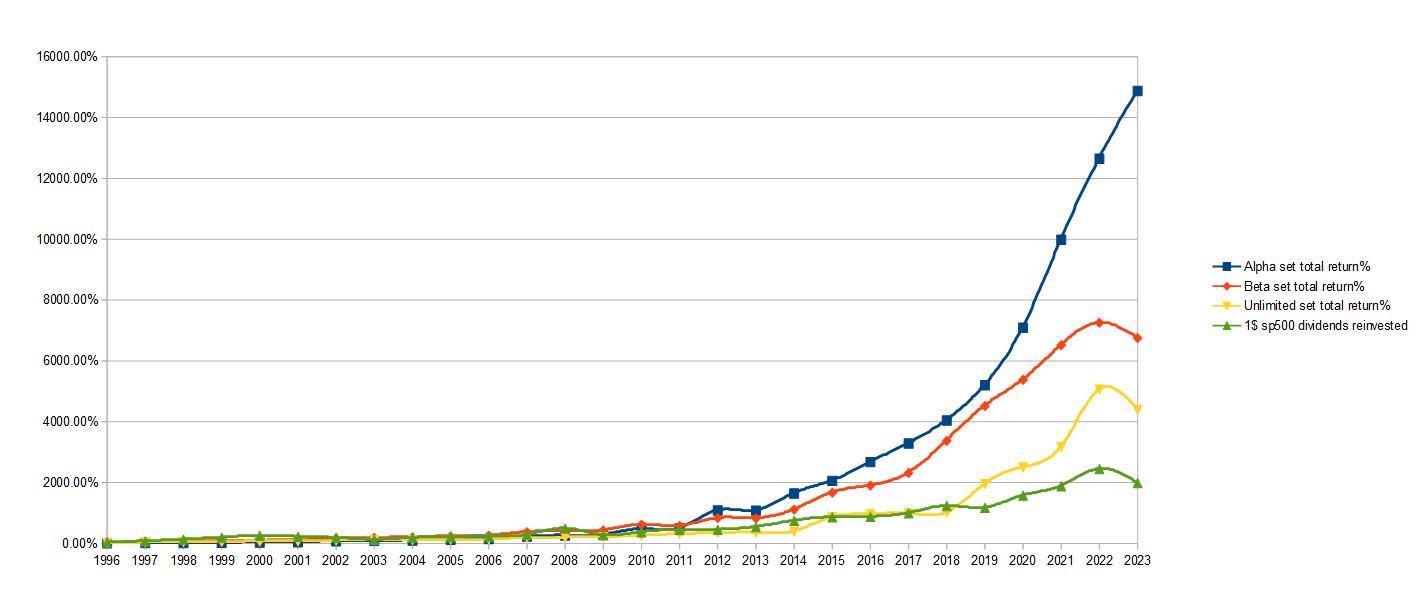

First off: From release to today:

As we’ve learned before, including the first year ( 1994-1995 ) skews this final data a lot because of the ludicrously low prices ( 12.50$ Alpha Lotus ).

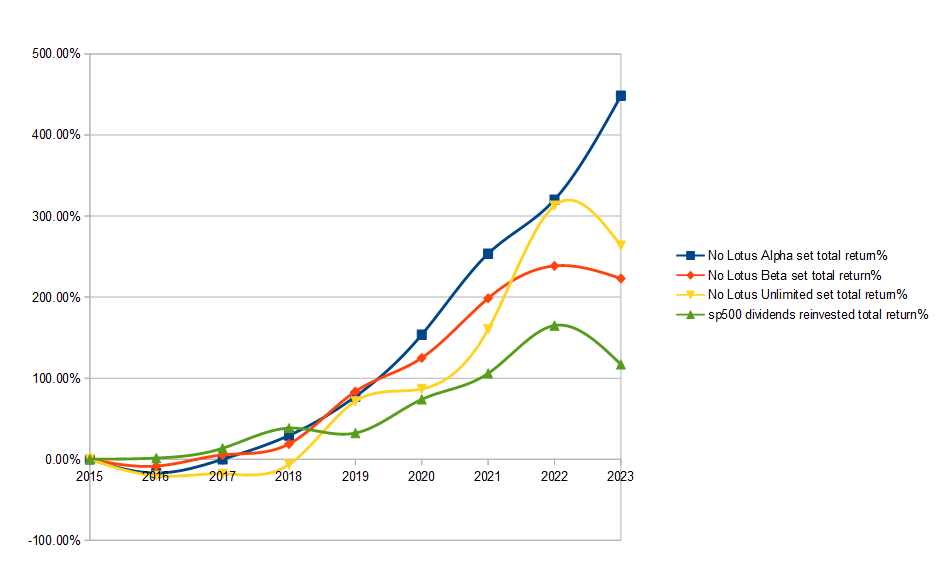

If you remove that year, we get this:

First thing to keep in mind: Index investing was still 20x your money in this time period. You’d be dumb to be sad about that kind of return.

Now what do we see for this longer period: Alpha beats Beta which beats Unlimited. Pretty much what we’d have guessed. Alpha beat Unlimited by quite a lot in fact, almost 4x.

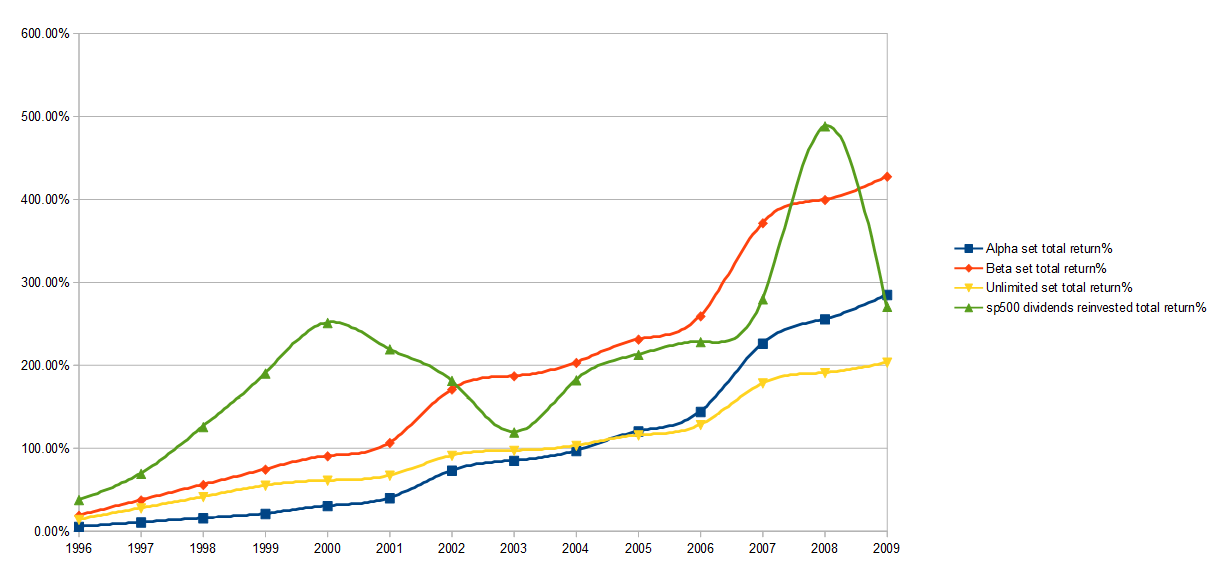

Let’s just check those early years though:

Woah, what’s going on there? Beta doing quite well here ( before Alpha cards were legal to play in tournaments ) and Unlimited trailing behind the Index. You can understand from data like this why nobody seriously would have invested in this early on. If you cut out that first year where a few people got to actually grab A/B/U at ludicrously low prices, magic cards didn’t do that great. In fact, spoiler alert: This is as good as it got for MTG in the early days. If you had anything BUT A/B/U, you got pretty decimated as Ebay prices slowly forced Scrye to print more accurate reflections of the global market prices.

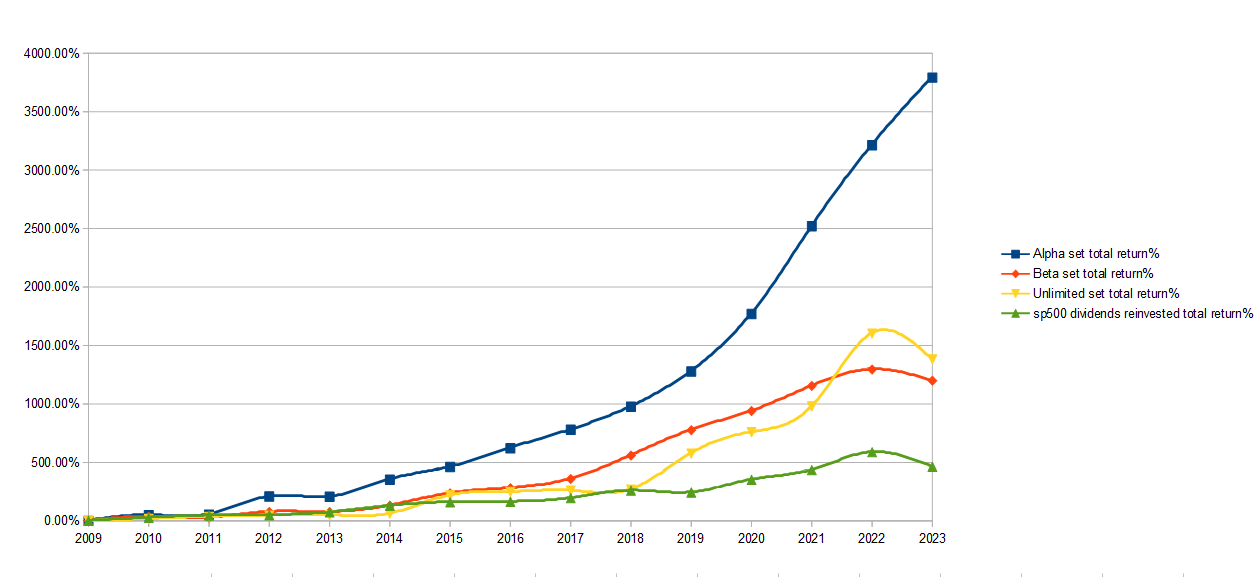

Now let’s check this post-Scrye period:

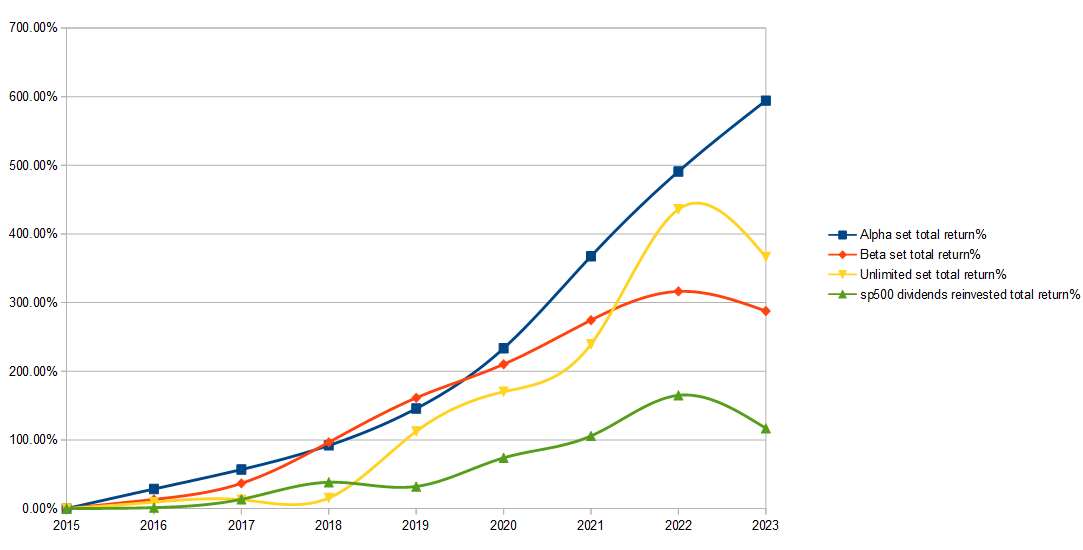

Very interesting to see Unlimited beating Beta in this time period. You see this is again where A/B/U starts to really crush the Index. Now let’s just focus a little more on the “Rudy” bump after 2015:

The gap closed a little bit between the 3 sets, but Alpha is still doing twice as good at Beta here. What if we just remove the Black Lotus from the 3 sets?

No surpise, the Lotus is the main driver of growth for all 3. Now Beta comes in at just 2x the Index instead of 3x. Alpha just 4.5x instead of 6x. Still, the order is maintained.

Conclusion: While it seems all 3 sets did okay, there’s a huge caveat: Beta commons and uncommons did not beat the index. They drag the set down. When you get to unlimited, many/most of the rares didn’t beat the index at all and just about all commons/uncommons did very badly. Commons to this day buylist for 10 cents, the same price they did back in 1994. If you had put 50k in Unlimited commons, you’d have been pretty much wiped out, but if you put 50k in P9/Duals then you did quite well.

How do you use this information? Well until price gaps become completely ludicrous between these sets, just put your money in Alpha. Even Alpha commons did pretty good. I also don’t see any reason to ever buy Beta commons or Unlimited commons/uncommons. You might get lucky in the short term but there’s too many of these things out there. If you’re talking about highly graded ones, maybe that’s a different ball game, but if you just plan to sit on stacks of Unlimited commons and expect them to do anything for you, you’re probably going to have a bad time.

Source/ Method for the MTG data: https://www.thepoxbox.com/posts/whats-my-card-worth

Other MTG related content:

Should I buy this collectible? - Another flowchart for Timmy

Investing in Collectibles - Is it dumb? - Initial look at the suspiciously high ROI of MTG

What’s a fair comparison? - Trying to fairly compare MTG to stocks

Omg should I grade this? - How rare is your card, really?

Magic Post-Covid market bloodbath - Coming off the 2021 cocaine high

Where do I sell my cards? - A flowchart for Timmy