Deconstructing Beta / Unlimited

I already did this for Alpha here.

Now one semi-valid caveat here is that ( especially for commons/uncommons ) certain cards are worth a lot more and so it’s mostly their price movement that’s being tracked ( especially later on ). For instance Alpha Lightning Bolt has a price of 720$ while Circle of Protections are just 23$, meaning the Bolt has 30x the weight in the overall trend.

It would be interesting to revisit this data with “average growth per card” instead but that’s pretty time consuming.

The main purpose of this initial deconstruction is just to check if random baskets of cards did or didn’t outperform the SP500 and how these baskets rank against each other. If you see Alpha rares did 20x Unlimited uncommons, there’s no point deconstructing the Uncommons further.

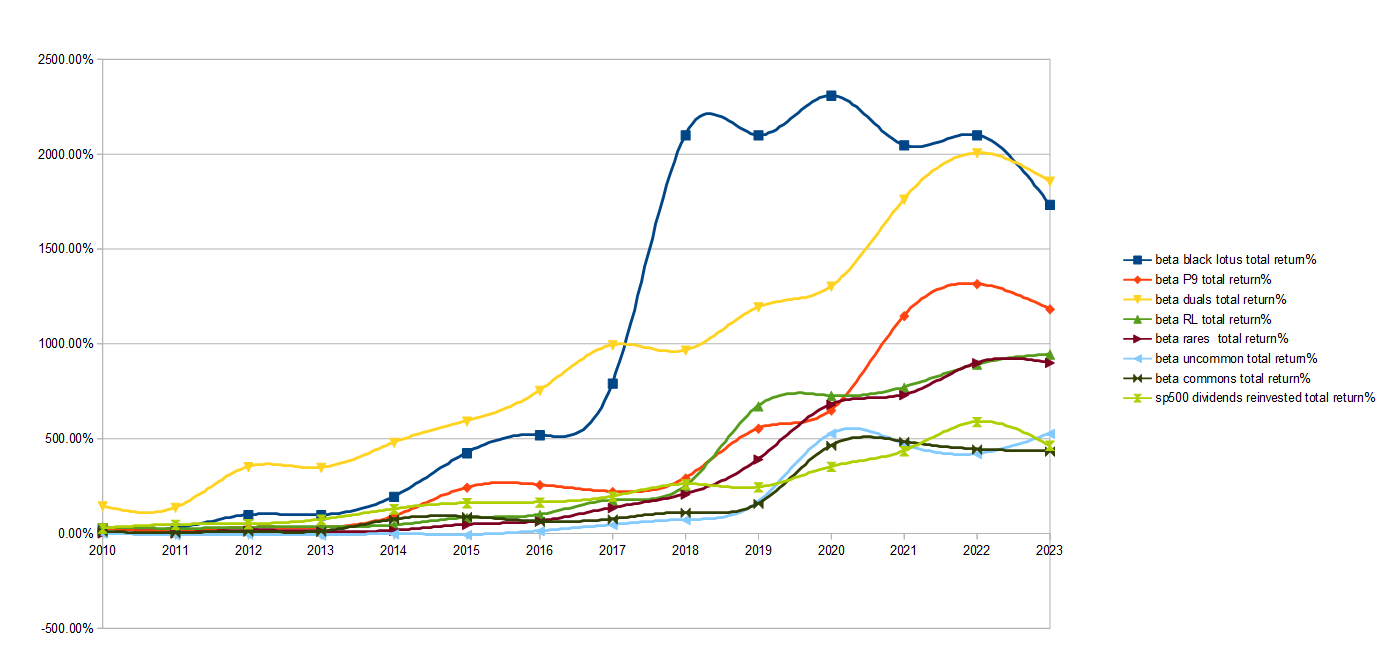

Now let’s just look at Beta categories:

* Each category does not include others, i.e. P9 does not include Lotus, RL does not include Duals/P9 and rares doesn’t include RL/P9/Duals/Lotus.

** This data exclude the first year ( 1994-1995 ) as the massive rapid initial price growth completely skews the data.

So interestingly, for Beta, the Dual Lands seem to have beaten everything else, even the Lotus. In the case of Alpha, the Lotus just kept up with the Duals at least.

Then notice Rares beat out RL. Same thing with Alpha. That’s because some of the rares like Shivan Dragon are highly collected and very expensive whereas many RL cards are just complete garbage with no organic collectability or demand.

Contrary to Alpha however we start to see that the lower categories of Beta are much closer to the SP500 returns.

Ok let’s look at the early period:

If you compare it to Alpha, you see that the early years of Beta were better. Alpha P9 only matched the SP500 in this period whereas Beta firmly beats it. I believe this is mainly due to this being the period where Beta was worth more because Alpha cards couldn’t be used in tournament play due to their wider corners.

Anyway only P9/Lotus and Duals beat the index in this early period of magic, but they still beat it by A LOT.

Now let’s look at the later period:

Now Lotus and Duals are neck in neck! They likely flip either way depending on what price data you’re using since data on Beta Lotuses is pretty inconsistent. We also see the RL climb back to where the Rares are, mainly due to the speculative bubble over everything RL. Gives you a glimpse into the future here: RL didn’t really matter before, it was better to own very collectible iconic cards then cards that sucked but wouldn’t be reprinted ( like say Darkpact ).

Now contrary to Alpha we see that commons/uncommons don’t significantly beat the Index anymore. Beta had roughly 3x the print run that Alpha did so it seems we’re already starting to find the point where cards become too common. Beta had 13 587 copies for uncommons and 48099 copies for commons.

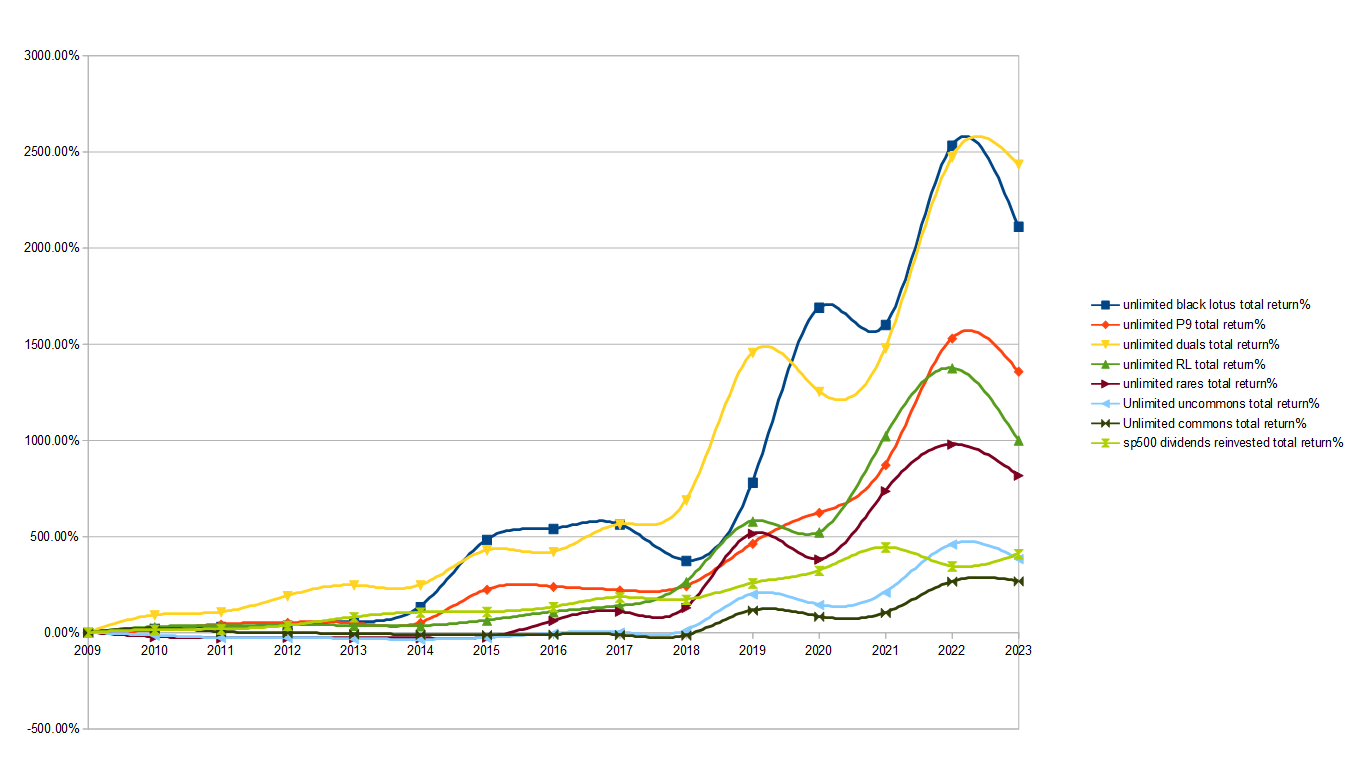

Ok now let’s have a gander at Unlimited! Now we’re almost 4x the print run of Beta, with 17k copies of the rares, 59k copies of the uncommons and 213k copies of the commons.

Duals and Lotus still dominating together. P9/Duals really crushed the SP500 here but everything else is close or well under.

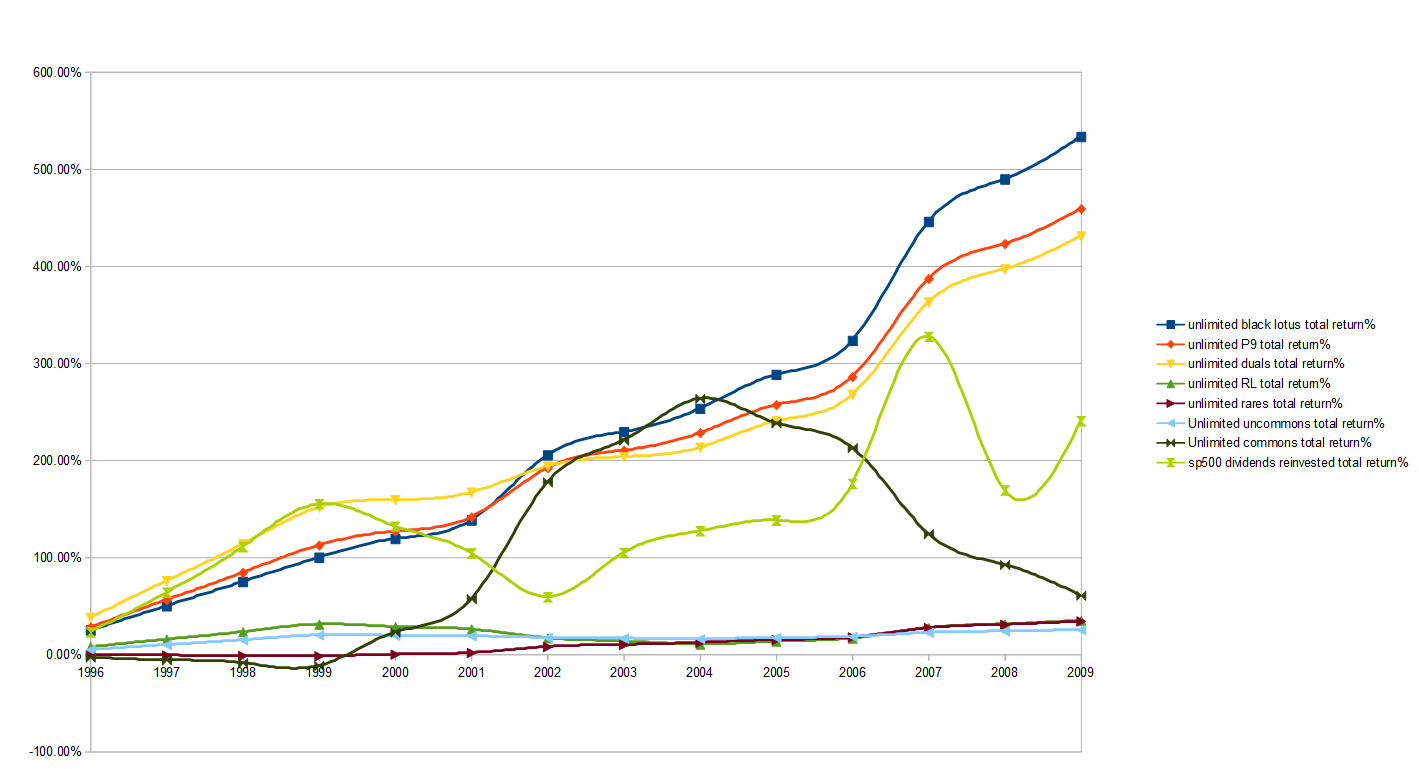

Let’s check the early history:

Contrary to Alpha and Beta we now see the SP500 crush most of Unlimited cards. The gap is getting narrower as well between the P9/Duals and the index. Where Beta has almost 4x market returns for the duals, Unlimited is down to “just” 2x.

Now the latest period:

Wow, Dual Lands and Lotus still quite close once again! You see rares and RL inflating themselves over the SP500 ( thanks to Rudy ) but given past performance, how likely is that to keep going?

It’s also at this point that commons and uncommons should probably be separated because by far the main drivers of these movements are just a select few highly sought after cards like Lightning Bolt and Sol Ring and almost all the rest is complete crap with no collectability to it. Still, even if you isolate the top 5 performers of these groups you wouldn’t have done better than the P9/Duals anyway so who cares?

Where some Unlimited rares definitely hold a bit of value just due to their rarity, I don’t believe this is true at all when you get to the uncommons which, again, have quite a large print run at 59 057 copies.

CONCLUSION

1- Everything Alpha did pretty well overall.

2-Already at Beta you should be suspicious of junk uncommons/ commons.

3-Unlimited junk rares / uncommons / commons are not investible.

4-Dual lands are king of A/B/U ( so far ).

But what did the best overall? We’ll look at that in another article. Did Alpha rares do better than everything in Unlimited anyway, meaning it was pointless to own any card from that set even if many beat the index?

We’ll check later!

Thanks for reading!

Source/ Method for the MTG data: https://www.thepoxbox.com/posts/whats-my-card-worth

Other MTG related content:

Should I buy this collectible? - Another flowchart for Timmy

Investing in Collectibles - Is it dumb? - Initial look at the suspiciously high ROI of MTG

What’s a fair comparison? - Trying to fairly compare MTG to stocks

Omg should I grade this? - How rare is your card, really?

Magic Post-Covid market bloodbath - Coming off the 2021 cocaine high

Where do I sell my cards? - A flowchart for Timmy